There’s almost always an imperfect alignment between company valuations and stock prices. That’s as true for gold stocks as it is for any other kind of stock…

And the discrepancy can at times be truly massive.

One example:

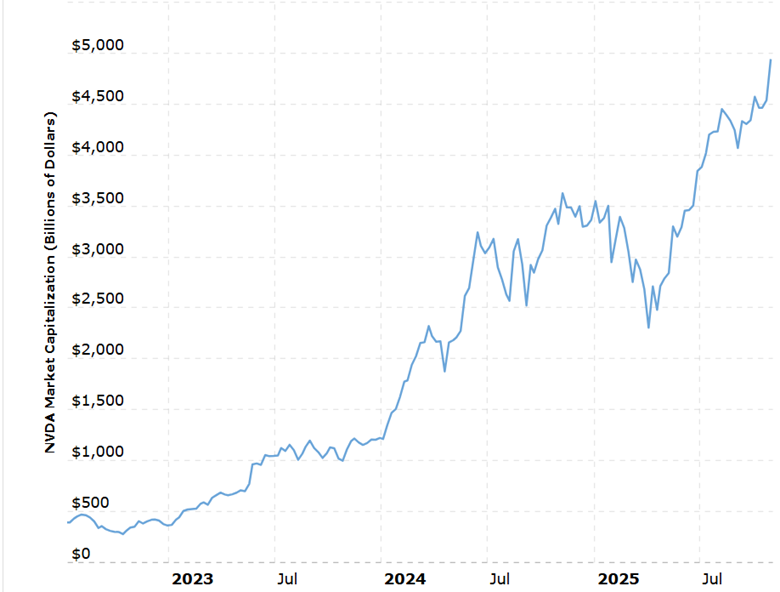

This week, Nvidia became the first publicly traded company to have a market cap of $5 trillion. That’s a considerable achievement, considering the first $1 trillion valuation happened in August of 2018 when Apple crossed that threshold.

Today there are over 10 publicly traded companies worth more than $1 trillion, and 5 that are worth more than $2 trillion. For more context, Nvidia only hit the $2 trillion mark in July of 2024…

That means in just the past 15 months, the market bid up Nvidia $3 trillion higher… That’s a record for a single company that dwarfs anything else we’ve seen in the stock market, ever.

From a purely intuitive perspective, you have to wonder what it means for so many companies to sprint past a $1 trillion market cap in the past 7 years. Is it because these companies are really that much more valuable? Maybe… but I think there’s another factor at play.

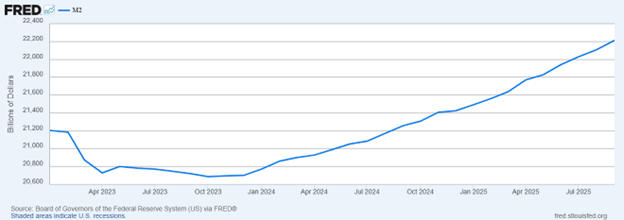

Here’s another chart, showing the growth in M2 money supply of the US dollar:

Looks kind of similar to the Nvidia chart, right? It’s almost as if money supply creation floods into certain assets…

Okay, so what does this have to do with gold?

There’s one other asset that saw its market cap grow even more than Nvidia over the past 15 months – and that’s gold, which added somewhere in the neighborhood of $10 trillion in market cap over the same time period.

To put Nvidia’s market cap explosion into perspective, I want you to guess what the market cap is for the top 50 largest gold stocks.

I’ll reveal it in a moment, but I’ll give you some details about these companies as a whole so you can see my thought process.

(And I know that comparing gold stocks to an outlier tech stock is not an apples to apples comparison – but it’s still an interesting thought exercise.)

Over the past year, these 50 gold companies have generated over $100 billion in revenue and $23 billion in profits.

Consider that through 2 quarters, Nvidia revenue is on pace to hit ~$160 billion for fiscal year 2026…

Nvidia also has a higher profit margin than gold stocks – and generated about $75 billion in profits.

Now… you have an idea of how the market is valuing Nvidia based on its profits and revenues…

Would it be out of line for the top 50 gold stocks to have a combined market cap that’s ⅓ as large as Nvidia’s? Consider that gold stocks generate about ⅓ as much profit on less revenue…

That would put the market cap of gold stocks at about $1.66 trillion.

Today, gold stocks aren’t even close. The total market cap for the top 50 largest publicly traded gold stocks is just over $550 billion. That means that compared to the valuation the market is assuming for Nvidia, gold majors are undervalued by at least 66%.

They would need to triple to get even with where the market values Nvidia, on a pure profit and revenue basis.

Another way to think about it: would you say that gold stocks are overvalued or undervalued relative to peers like Nvidia?

It’s a relevant question if only because it’s obvious that money creation is heavily correlated with the rise of the Trillion dollar company – and yet we simply have not seen much of a move in gold stocks despite a massive move in gold.

Something has to give. And if the gold stock market sees anything close to the kind of surge we’ve seen in either tech stocks like Nvidia OR even in gold itself, we’re in for a historic ride that has barely begun.

Best,

Garrett Goggin, CFA, CMT

Lead Analyst and Founder, Golden Portfolio